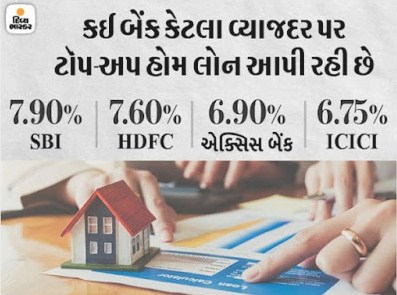

Top up home loan can be taken if money is needed, the bank offers this loan at low interest rate.

The top up on a home loan can be taken for a period of 30 years.The bank easily approves a top up loan on timely payment of EMI of the home loan.Many people have faced financial difficulties during the Corona period. Some people are thinking of taking a personal loan, but the interest rate for this type of loan is 10 to 24%. Not all interest rates are affordable. If you have taken a home loan, you can take a top up loan on the loan. Doing so can get you a loan at a lower interest rate. Here are some tips to help you get a top up home loan ...

Get a low interest rate loan

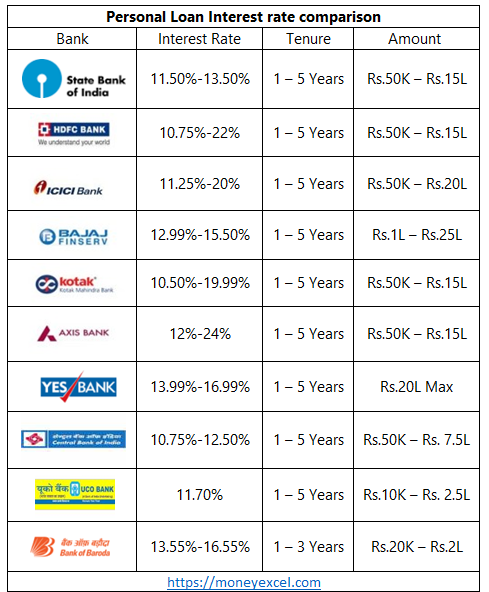

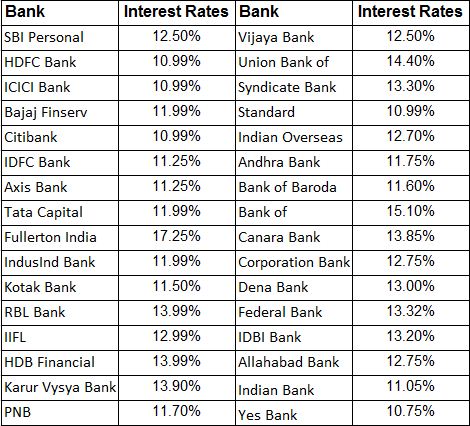

Can a person avail of a personal loan and a home loan simultaneously?

Yes, a person can have a personal loan and a home loan account at the same time. If you have an ongoing personal loan and you are seeking a home loan, then you can apply for it. The only condition is that your debt to income ratio should not be above 50%. You can have multiple personal loans and yet apply for a home loan. You should ensure having higher creditworthiness so that you can manage home loan and personal loan repayments.

CASHe is the easiest way to get personal loan online for salaried professionals with monthly net take-home of ₹12,000 or more. Our loan app disburses short-term loans as soon as possible.The CASHe personal loan app reduces paperwork eliminating human intervention. Apply for personal loan from ₹1000 to ₹4,00,000.CASHe adheres to RBI’s Fair Practice Code & is committed to promote best practices in digital lending.

What’s New?

CASHe Credit Line

One approval, multiple loans. With minimal documentation and instant approval, apply for a credit line with a 1-year tenure to avail short-term loans for emergency & shopping needs.

Buy Now Pay Later with CASHe

Log on to CASHe and get 0%* interest online shopping loan on this pay later app with leading merchants like Amazon, Flipkart, Big Bazaar, Big Basket, Apollo Pharmacy, Uber and Myntra to make your purchases now and pay later with easy EMIs.

Personal Loan Eligibility:

● Personal loan for salaried professionals only

● Minimum net take-home monthly salary: ₹12000

● Above 21 years of age

● Salary through direct bank transfer only

Features of CASHe – Personal Loan App:

● Avail a range of personal loans

● Personal loan eligibility check

● Personal loans available from ₹1,000 – ₹4,00,000

● Quick loan application via online loan app

● Repayment period to be more than 3 months

● No guarantors or collaterals needed

● 100% paperless loan application

● No foreclosure charges

● Get instant credit line

● Enjoy online shopping at no cost EMI*

● Loan instantly credited to bank account

● Loan repayment through various channels

Avail the money you need, when you need it, for whatever purpose with CASHe. It is simple, transparent, and the best online personal loan app in India.

Get up to ₹4,00,000 personal loan online or avail credit line using the CASHe app. Know your personal loan eligibility in minutes and apply for a personal loan easily.

Over 7 million users have downloaded the CASHe personal loan app. Download the app today and experience a new way of borrowing!

How to apply for personal loan online on CASHe?

● Install the CASHe app

● Log in to CASHe personal loan app by registering through your social media account

● Fill in your basic details to know your personal loan eligibility

● Submit KYC documents and apply for a quick personal loan

● Once application is approved, we transfer the loan directly to your bank account

Documents required to apply for a loan:

● Selfie

● PAN card

● ID Proof (Any 1 - Driving License/Voter ID/Passport/Aadhaar Card)

● Address proof (Any 1 - Driving License/Voter ID/Passport/Aadhaar Card/Utility Bills)

● 3 month bank statements with salary credit

● Aadhaar card (Optional; Aadhaar details quicken loan application process)

Interest, tenures and other specifications

● Annual Percentage Rate (APR) – 33.46%

● Minimum Repayment Tenure: 3 months

● Maximum Repayment Tenure: 18 months

● CASHe 1.5 - Processing fee: 3% or 1000 whichever is higher

● CASHe 180, CASHe 270: CASHe 1 year - Processing fee, 2% or 1200 whichever is higher

● CASHe 90 - Processing fee: 1.5% or 1000 whichever is higher

Sample Loan Calculation

Loan amount: ₹ 30,000 at interest rate of 33.46% p.a.

Loan Duration: 3 Months

Total personal loan interest = ₹ 2,475

Processing fees (PF) + GST = ₹ 1000 + ₹ 180 = ₹ 1,180

Total Deductibles (PF + GST + Interest): ₹ 3,655

In-Hand Amount: Loan Amount - Total Deductibles = ₹ 30,000 - 3,655 = ₹ 26,345

Total repayable Amount: ₹ 30,000

Monthly EMI Repayable: ₹ 10,000

The deductibles (interest + PF + GST) are deducted upfront during the loan disbursal.

Data Security via Secure Loan Application

Your data is safe with us. All the transactions are secured via a 128-bit SSL encryption. Data is transferred over secured connections.

Use the Money View Loans App to get instant personal loans starting from ₹10,000 up to ₹5,00,000 in just a few minutes! Our Annual Interest rates (APR) vary from 16% to 39%* & you can choose from a wide range of flexible EMI repayment plans starting from 3 months & going up to 5 years.

Money View is trusted by more than 1Cr users across India.

For example, a loan of ₹50,000 with an annual interest rate (APR) of 24% and a repayment tenure of 12 months has a processing fee of ₹1,750 + ₹315 GST (No additional fee) & a monthly EMI of ₹4,728. The disbursed amount is ₹47,935 & the Total interest is ₹6,736. The total loan repayment amount is ₹56,736.

*These numbers are for representation only and the final interest rate or processing fee may vary from one borrower to another depending on his/her credit assessment.